Collateral

Sales decks, tools, and resources for CS and Sales teams.

Decks

Full Sales Deck v2

Complete sales presentation covering all Boostly products, value props, and case studies.

Activation Deck

Onboarding presentation for new customers covering setup and best practices.

Case Studies

All Case Studies Folder

Google Drive folder containing all case study documents and materials.

Westside Pizza Case Study (V2)

31-location corporate case study showing $85k revenue, 16k subscribers, and 550 Google reviews.

Fox's Pizza Den Case Study

Franchise case study demonstrating Boostly's impact on multi-location operations.

Domino's 90-Day Impact (V2)

90-day results analysis for Domino's franchise locations.

Marketing Packages Case Studies

Compilation of case studies for various marketing package offerings.

Wasserhund Brewing 60-Day Report

60-day SEO results showing visibility and engagement improvements, better map rankings.

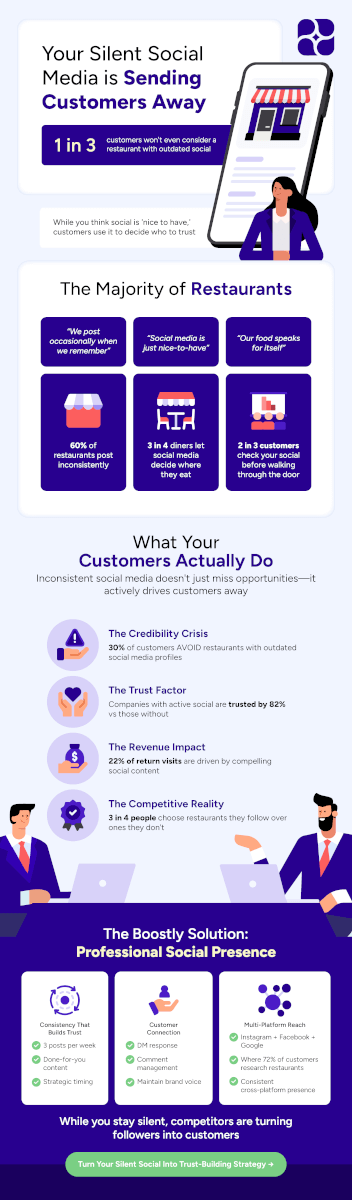

Social Media Examples

Examples of social media marketing work for customers with the SM marketing package.

Process Documents

Visual Assets

Videos

Optimize Your Google Business Profile

Tutorial on optimizing Google Business Profile for restaurant success and local SEO.

Hashtags Strategy

Best practices for hashtag usage in restaurant social media marketing.

Reposts on Instagram

Guide to leveraging reposts and user-generated content on Instagram.

Pricing

Pricing details for all Boostly products pulled from Stripe.

Loading pricing data...

Integrations

Integrations

Direct integrations that automatically sync customer data with Boostly.

Slice

Pizza ordering platform integration

Toast

Restaurant POS integration

Boostly Voice

AI phone ordering integration

Menufy

Online ordering integration

Grubhub

Delivery platform integration

ChowNow

Online ordering integration

HungerRush

Restaurant technology integration

Orders2Me

Online ordering integration

POS & Ordering Systems We Pull Data From

We can import customer data from these point-of-sale and online ordering systems via CSV export.

Don't see their system? We can still work with them if their POS/OLO has a way to export customer phone numbers. Ask them to check with their provider.

Trends & Stats

Industry statistics and trends to establish authority with restaurant owners. Use these numbers in conversations with prospects.

Industry Stats

Key restaurant industry benchmarks for 2025. View full report →

Market Size & Growth

- $1.5 trillion total US foodservice sales in 2025 — NRA 2025

- $1.1 trillion traditional restaurant sales (73% of total)

- 4% nominal growth but real growth near flat (-0.2%) after inflation — Technomic

Profit Margins (Net, After All Expenses)

| Segment | Net Margin |

|---|---|

| Full-Service | 2.8-5% |

| Limited-Service/QSR | 4-6% |

| Fast Casual | 6-9% |

| Fine Dining | 6-10% |

| Ghost Kitchen | 8-15% |

Source: Toast, NRA Operations Data 2025

Cost Structure

- Food costs: 30-35% of revenue (median 32%)

- Labor costs: 25-40% of revenue (median 36.5% for full-service)

- Other costs: ~28% (rent, utilities, marketing, insurance, supplies)

- Prime cost target: 55-60% (food + labor combined)

Source: NRA Restaurant Profitability 2024

Customer Lifetime Value

| Customer Type | % of Base | Avg LTV |

|---|---|---|

| One-time visitors | 69% | $26 |

| Occasional guests | 19% | $345 |

| Regular guests | 8% | $685 |

| Loyal guests | 4% | $1,490 |

- 78.8% annual churn rate — only ~21% of last year's customers return

- 69% of guests never return after first visit

- Top 12% of customers (regular+) generate ~40% of total revenue

- Acquiring new customer costs 5-7x more than retaining existing

Source: Bloom Intelligence 2025

Industry Trends 2025

Key shifts shaping the restaurant industry. View full report →

Growth Segments vs Declining

Growing

- Fast-casual chicken: +24% sales growth (Raising Cane's +32%)

- Mexican: +11% fast-casual growth (Chipotle +14.7%)

- Korean cuisine: +10% (450 new restaurants)

- Fast casual overall: +3.2% visit growth vs +0.4% for QSR

Struggling

- Pizza: 61% of chains declining; -2.9% CAGR over 5 years

- QSR Burgers: Only +1.4% growth (below 4% inflation)

- McDonald's: +0.6% (first same-store decline since 2020)

- Arby's: -5.5% sales decline

Source: Technomic Top 500

GLP-1 Impact on Dining

- 12.4% of US adults now taking GLP-1 medications (doubled from 5.8% in Feb 2024)

- Users reduce spending at restaurants by 8.0-8.6% within 6 months — Cornell University

- 63% of users spending less on dining; visiting 50% less frequently — Morgan Stanley

- 41% ordering smaller portions; 62% drinking less alcohol

- Smoothie King launched dedicated GLP-1 Support Menu (Oct 2024); Olive Garden added "Lighter Portions"

Consumer Behavior Shifts

- "Meal deal" searches up 117%; "cheap eats" up 21% — Yelp 2025

- 40% of Americans are now "value seekers" — Deloitte

- "Solo dining" searches up 271%; solo diners spend 48% more per person ($84 avg)

- "Le Petit Chef" (immersive dining) up 509%; experiential dining demand surging

What's Working: Loyalty Programs

- Loyalty sales up 34% vs slight decline in non-loyalty sales — Bank of America

- 75% of QSR brands with loyalty reported increased traffic

- Top operators drive 37%+ of transactions via loyalty members

- Starbucks Rewards: 57% of US revenue, members spend 3x more

Source: Paytronix 2024

Technology Adoption

- 79% of operators have implemented or considering AI — Popmenu

- Online ordering grows check avg by 26% for QSR, 13% for fast casual

- Restaurant kiosks grew 43% worldwide (2021-2023); drive 10-30% higher AOV

- 30% of Gen Z use TikTok for restaurant discovery — DoorDash

Text Marketing Stats

SMS marketing benchmarks that prove the channel's effectiveness. View full report →

SMS vs Other Channels

| Metric | SMS | |

|---|---|---|

| Open Rate | 98% | ~20% |

| Response Rate | 45% | 6% |

| Click-Through Rate | 18% | 2% |

| Read Within 3 Min | 90% | — |

Sources: SimpleTexting, Peblla

Revenue Impact

- SMS marketing contributes 10-20% of monthly revenue for engaged restaurants

- 21-30% conversion rate in restaurant industry

- Dormant customer reactivation: 5-7% return rate from re-engagement SMS

- SMS recipients visit nearly 3x more frequently than non-recipients

Source: Simple Loyalty Case Study

Consumer Adoption

- 84% of consumers are opted in to receive texts from businesses

- 91% of guests express interest in signing up for text notifications

- 35% growth in SMS marketing opt-ins since 2021

Source: Incentivio

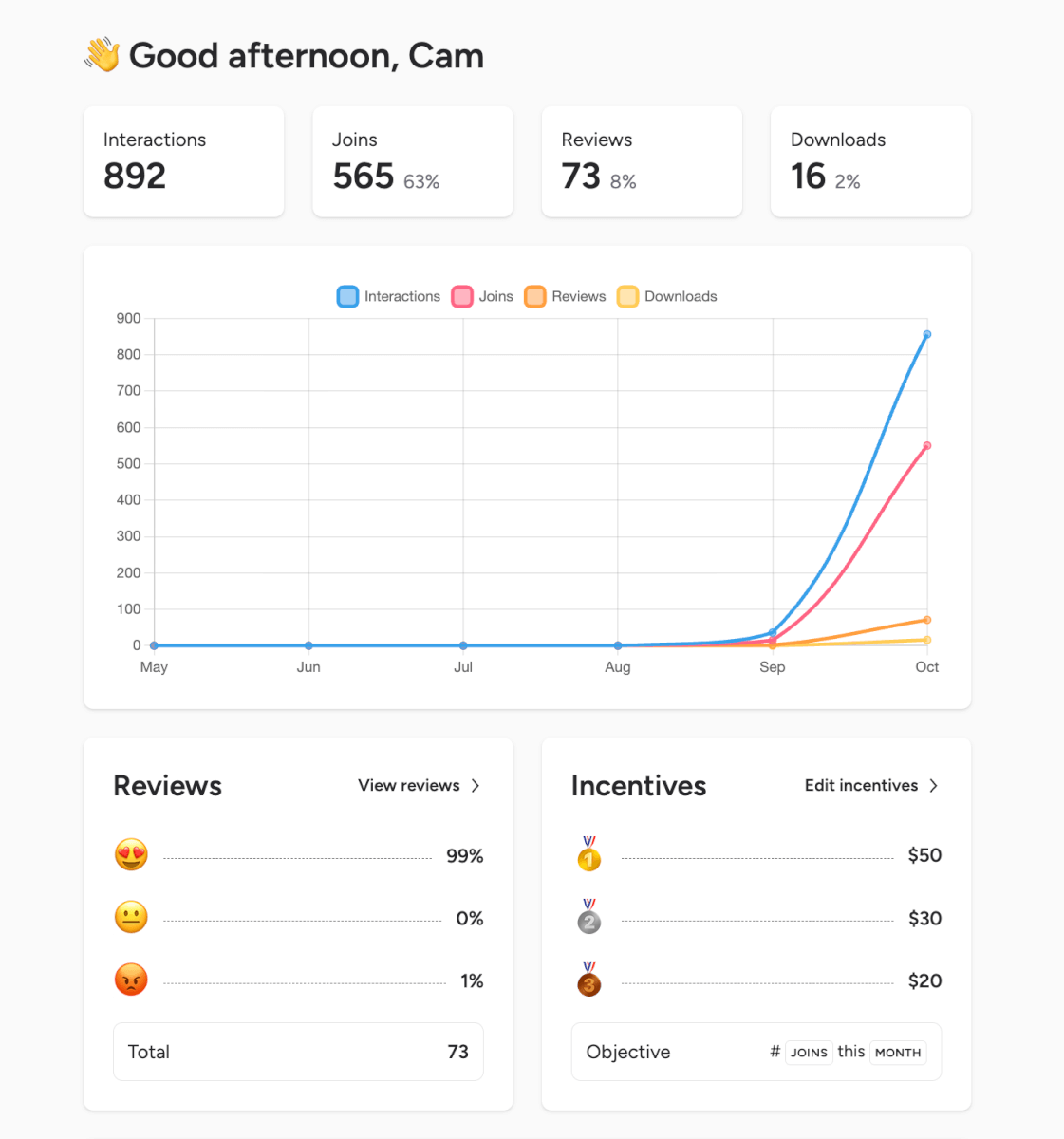

Boostly Outcomes Data

Boostly's own data on SMS subscriber value, based on 3.2M+ orders across 89 restaurant locations. View full report →

Subscriber Lifetime Value

- +59% higher LTV — $144.28 avg for subscribers vs $90.49 for non-subscribers

- 55 days sooner — Subscribers return every ~95 days vs ~150 days for non-subscribers

- +6% higher AOV — $49.58 avg order value vs $46.64

Repeat & Loyalty Rates

- +47% more repeat customers — 34.7% of subscribers order 3+ times vs 23.5%

- +83% more loyal customers — 18.5% of subscribers order 5+ times vs 10.1%

- Subscribers are 1.83x more likely to become high-frequency customers

"Punch Above Weight" Stats

- SMS subscribers are only 5.9% of customers

- But they account for 8.6% of orders and 7.6% of revenue

- That's 29% more value than their customer share would suggest

Loyalty Program Stacking (Boostly + Toast)

| Segment | Avg LTV | Lift vs Baseline |

|---|---|---|

| Both programs | $169.74 | +114% |

| Toast Loyalty only | $135.68 | +71% |

| Boostly SMS only | $115.23 | +46% |

| Neither (baseline) | $79.15 | — |

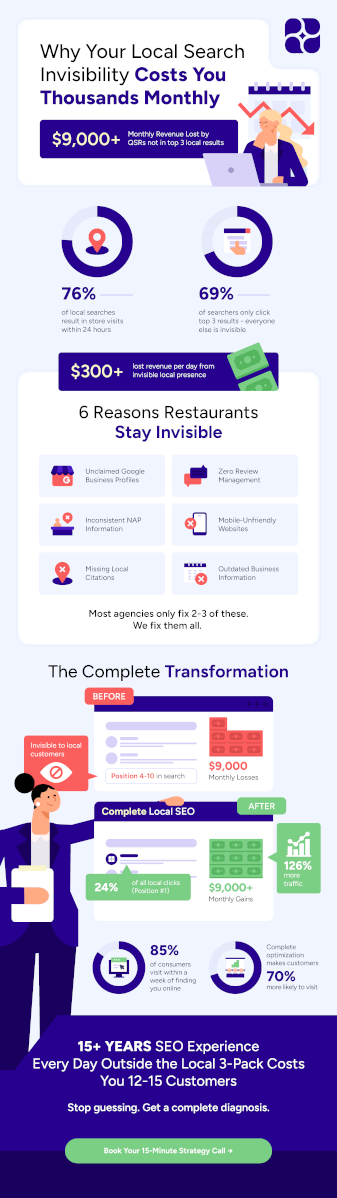

Local SEO Stats

Why local search visibility matters for restaurants. View full report →

Google Maps Local Pack

- 42-44% of local searchers click on Google Maps Local Pack results (vs 29% organic, 21% ads)

- Position #1: 17.6% CTR, #2: 15.4%, #3: 15.1%

- Top 3 positions get 126% more traffic and 93% more actions than positions 4-10

Sources: SEO Design Chicago, First Page Sage

Google Business Profile Impact

- Complete profiles receive 7x more clicks — Google

- Businesses with photos get 35% more website clicks — BrightLocal

- Diners are 83% more likely to order after viewing dish photos

Revenue Connection

- Restaurant bookings from local search increased 654% YoY — Yelp 2024

- 90% of diners research restaurants online first

- SEO-optimized restaurants see up to 3.5x more visibility

Review Stats

The revenue impact of online reviews, backed by academic research. View full report →

Revenue Impact (Harvard & Berkeley Studies)

- One-star increase = 5-9% revenue increase for independent restaurants — Harvard Business School

- Half-star improvement = 19% more likely to sell out during peak hours — UC Berkeley

- For a restaurant doing $1M/year, one star = $50,000-$90,000 additional revenue

Consumer Behavior

- 94% of diners read reviews before choosing a restaurant — BrightLocal

- 88% of Americans trust online reviews as much as personal recommendations

- 80% of customers use rating filters when searching

Reviews & SEO

- Reviews contribute 15% to Local Pack rankings — Midland Marketing

- 97% of review readers also read the business's responses — Mobal

- 88% of consumers more likely to choose businesses that reply to all reviews

- Customers spend 50% more with companies that engage with reviews — EmbedSocial

Brand Guide

Official Boostly brand assets, typography, and color palette. Click any hex code to copy it.

Logos

Horizontal

Vertical

Icon Only

Typography

Figtree is a clean yet friendly geometric sans serif font for usage in web and mobile apps. It's light-hearted and crisp when used for text, yet still retains some punch when used in uppercase — perfect for buttons and short labels. The thicker weights have a distinctly friendlier character, great for headlines of more personable brands.

Figtree comes as a variable font with 7 legacy weights, light through black, and supports 280+ Latin languages.

Color Palette

Click any swatch to copy the hex code.